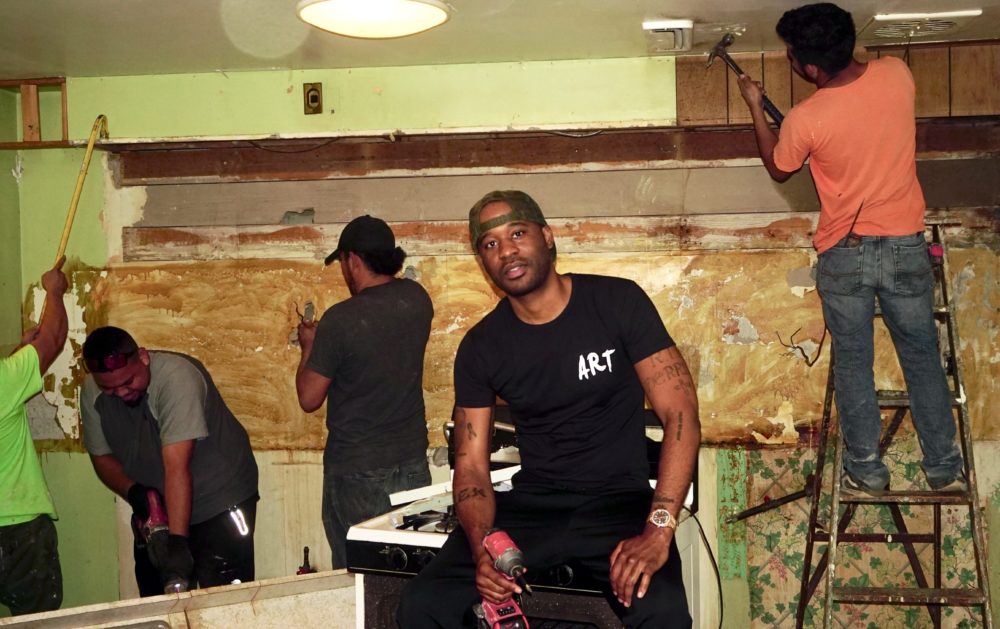

When first meeting Mark Whitten, you probably wouldn’t suspect that he’s a successful real estate investor from Baltimore, Maryland, but that’s why you shouldn’t judge a book by its cover. Over the last 10 years, the Morgan State University graduate has accumulated an impressive real estate portfolio through wholesaling deals and buying and holding properties. Because of his passion for real estate and sharing his wealth of knowledge with others, he launched a coaching program designed to educate and prepare future real investors to use real estate as a vehicle to generate wealth. Whitten even offers attractive incentives for his students, such as giving away free houses and “cash money” giveaways.

Black Enterprise spoke to Whitten about his real estate journey.

BE: When and how did you get your start in real estate?

Whitten: It all started as a child, I always looked at what I had compared to what I saw on TV. I was always amazed that there were actually people in the world who were successful and seemed to have lots of money. Growing up, I watched my single mother of three struggle to make ends meet, but she always made a way. My mother worked three jobs to keep a roof over our heads and couldn’t spend as much time as she wanted with my older brother Derrick, who died of cancer at the age of 19. This caused me to develop a mindset with a burning desire to be successful early on and begin to look for a way out.

Fast forward, when I graduated from Morgan State University in 2005 with a degree in Marketing, the job market in my field was a little tough so a friend helped me get a job working at a group home. I remember I would go to work every day and sneak to read books on real estate because, according to my research, real estate had created the most millionaires in the world. So, I continued to read every book I could to educate myself and then I found mentors to help shorten my learning curve.

BE: When did you realize real estate investing would be your long–term career plan?

I realized real estate investing would be my long term career plan once I started making a ton of money doing deals. I would make more money on one deal than I would make in a few months working at the group home. I also learned the importance of ownership, equity, and cash flow. For example, I can own a home worth $200,000 that I paid $60,000 for and spent $40,000 in renovation to make it worth $200,000. My net worth now increases $100,000 and I have $100,000 in equity. I can now rent that home to a section 8 tenant and receive positive cash flow every month in rental income. So, if the rent is $1,800 a month and my expenses are $1,000 a month (mortgage, taxes, insurance), that would be $800 a month in positive cash flow. Now, imagine doing that over and over again; all your bills would be paid and you can truly create financial freedom.