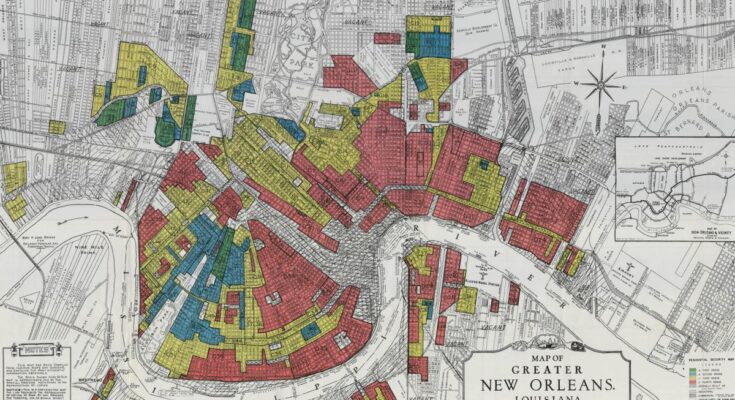

Redlining is a discriminatory practice in real estate, typically involving mortgage lenders that refuse to lend money or extend credit to borrowers in certain areas of town.1 The term can also apply when real estate agents follow similar practices in showing homes.2

What Is Redlining?

The act is dubbed redlining for the “presumed practice of mortgage lenders of drawing red lines around portions of a map to indicate areas or neighborhoods in which they do not want to make loans.” These red-lined areas are typically occupied by people in certain socioeconomic groups—those with lower incomes or of a certain color or race.1

NOTE: There’s also a practice called reverse redlining. This is when lenders target a specific area or neighborhood when marketing high-cost or predatory mortgage loans.

The Fair Housing Act

The Fair Housing Act is contained in the Civil Rights Act of 1968 and modified by the Fair Housing Amendments Act of 1988. The act makes it illegal to discriminate in the sale, rental, advertising, or availability of real estate transactions on the basis of:3

- Race

- Color

- Religion

- National Origin

- Sex

- Disability

- Familial Status

Under the Fair Housing Act, it’s illegal for real estate agents to steer you toward particular neighborhoods based on any of the above factors. It also means they must use inclusive advertising and marketing strategies, as well as inform you of your rights under the Act.7

Lending institutions are also required to abide by Fair Housing practices and may not disqualify loan applicants due to their socioeconomic backgrounds, racial group, or other features. It is also unlawful for a bank to charge a higher interest rate for people based on the categories listed above. Interest rates should be competitive across the board for people of equal financial standing.1

Discriminatory vs. Creditworthy

It’s important to note the difference between discriminatory and creditworthy here. While banks and lenders can’t deny you a loan based on your race, gender, or disability, they can deny you for other reasons.

Banks are free to set their own lending standards based on economic characteristics such as credit score, debt levels, and employment income. The Fair Housing Act also allows lenders to consider things like the property’s condition, local home values, neighborhood amenities, and their own need for a balanced loan portfolio when evaluating an applicant.

IMPORTANT: Banks can refuse to approve loans on properties they deem unworthy of investment. For instance, if a buyer wanted to purchase a home in an area where regular flooding or landslides occur, a bank would not have to approve the request for a mortgage.

Preventing Redlining

The Home Mortgage Disclosure Act was created in 1975 to help stave off redlining and other discriminatory lending practices. The law requires lenders to track and regularly report loan-level data to the Consumer Financial Protection Bureau.8

This allows the CFPB and Department of Justice to regularly evaluate lending practices and ensure borrowers are being treated fairly, equitably, and in line with Fair Housing practices.

TIP: When a mortgage application asks for your ethnicity, it might be a good idea to answer. The federal government collects and reviews information from loan applications to determine whether redlining is occurring.

The Bottom Line

Redlining is illegal. But though laws and measures are in place to prevent it from happening, the practice still occurs across the country. If you feel you have been a victim of redlining and want to file a Fair Housing complaint, you can do so online for free at HUD.gov.

(By