A day after the American Petroleum Institute estimated commercial U.S. crude oil inventories hade declined by 1.83 million barrels last week and amid an unplanned production outage at the Buzzard field in the North Sea, the Energy Information Administration hit markets with a 1.6-million-barrel increase in commercial inventories as of the end of last week.

This is compared with a 900,000-barrel build in inventories for the week to March 24, which made traders perk up because the figure was substantially lower than API estimates for the period, which pegged the build at 1.9 million barrels.

The report comes amid growing investor optimism about the OPEC production cut deal, as tanker tracking data reported by Reuters has revealed that global seaborne crude oil supply is falling.

While this is significant in light of the fact that most OPEC oil from the Middle East is shipped in tankers around the world, it is by no means the only global supply, and production elsewhere can still be rising at steady rates, undermining the OPEC deal and keeping a lid on prices.

EIA’s report also said that refineries processed an average daily of 16.4 million barrels of crude, slightly up from 16.2 million bpd in the previous week, producing 9.5 million barrels per day of gasoline and 5 million barrels per day of distillate. Gasoline inventories fell by 600,000 barrels last week.

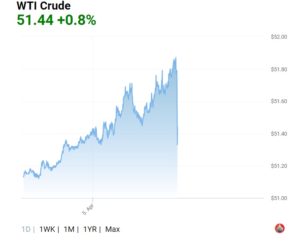

Oil prices reached a one-month high earlier this week on the back of the Buzzard outage and the API figures, but EIA’s report might reverse the trend, especially combined with another headwind for prices: Libya’s restored oil production, after a temporary suspension at its biggest field, Sharara, that took 250,000 bpd off daily output last weekend.

At the time of writing, Brent crude was trading at $54.66 a barrel and West Texas Intermediate was changing hands at $51.44 a barrel, with prices starting to slide shortly after the data release. (Courtesy of Oilprice.com)